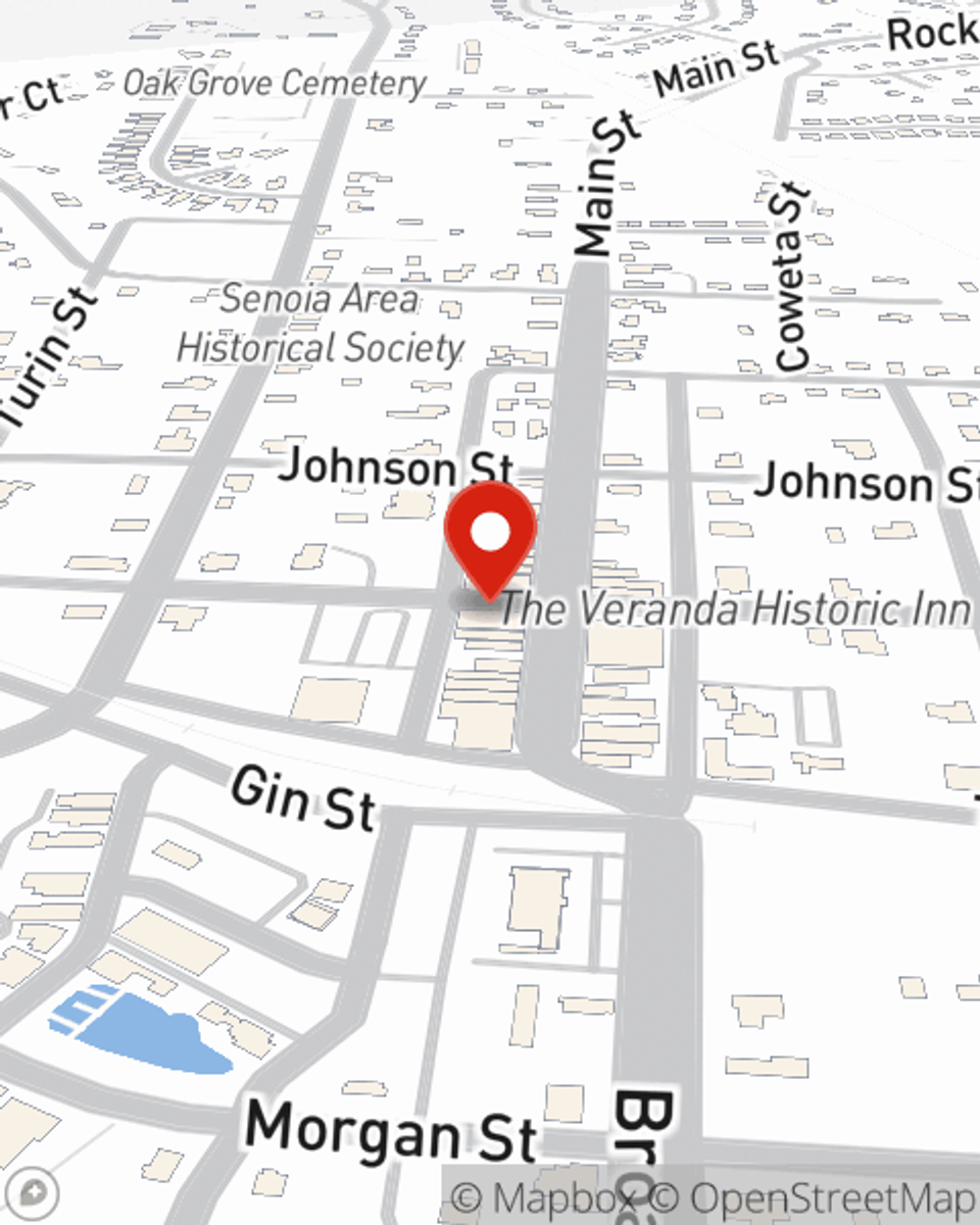

Business Insurance in and around Senoia

One of Senoia’s top choices for small business insurance.

No funny business here

- Coweta County

- Fayette County

- Spalding County

- Meriwhether County

- Troup County

Help Protect Your Business With State Farm.

Preparation is key for when something unavoidable happens on your business's property like an employee getting injured.

One of Senoia’s top choices for small business insurance.

No funny business here

Customizable Coverage For Your Business

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like extra liability or worker's compensation for your employees, that can be designed to develop a personalized policy to fit your small business's needs. And when the unexpected does happen, agent Chase Mewbourn can also help you file your claim.

Don’t let the unknown about your business keep you up at night! Call or email State Farm agent Chase Mewbourn today, and find out how you can meet your needs with State Farm small business insurance.

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Chase Mewbourn

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".